Maryland Land Development News

LAND LESSONS – You Can’t Get There from Here

You can’t get there from here. For the last twenty-seven years that I have been a land broker, I have invited my friends who are division presidents or land acquisition managers for home builders to break bread with me – one-on-one – during the first weeks of January. I truly enjoy these meals, when we…

Read MoreLAND LESSONS- What are Metes and Bounds?

A type of survey used in England and many of its colonies, it uses the physical features of the local geography, along with directions and distances, to define and describe the boundaries of a parcel of land. The boundaries are described in a running prose style, working around the parcel in sequence, from a point…

Read MoreLAND LESSONS- What is the difference between Real Property and Real Estate?

What is Real Estate?Real estate is defined as land and the buildings on it, along with its natural resources such as growing crops, minerals, water, and wild animals; immovable property such as trees and rocks BUT NOT the specific rights that come with ownership such as well as the right to sell the mineral rights…

Read MoreLAND LESSONS- New to Land Entitlements? Here is a little advice.

“Bureaucracy is the epoxy that greases the wheels of progress.”- James Boren Why does it take two, three or five years to obtain all the necessary entitlements required to build a residential subdivision or commercial development in Maryland? Appreciate that more than 20 separate government agencies including planning, public works, parks & recreation, natural resources all need…

Read MoreLAND LESSONS- What is a Priority Funding Area?

Priority Funding Areas (PFA’s) are existing communities and places designated by local governments indicating where they want investment to support future growth. Growth-related projects covered by the legislation include most state programs that encourage or support growth and development such as highways, sewer and water construction, economic development assistance and state leases or construction of new…

Read MoreLAND LESSONS- What is meant by the term “Right of Way”?

Many confuse the term ”right of way” with the term ”easement“. Though they do similar things, they are different. Essentially, all rights-of-way are easements, but not all easements are rights-of-way. Rights-of-way are easements that specifically grant the holder the right to travel over another’s property. Easements are nonpossessory interests in real property. More simply, an easement…

Read MoreLAND LESSONS- What is meant by the characteristics of land?

Land, unlike real estate or real property, has certain unique and specific characteristics that it alone holds. They are typically discussed in the context of physical and non-economic characteristics of land. Physical Characteristics Indestructibility: Land cannot be destroyed or worn out. Its appearance may be altered but it always continues to exist. Immobility: Geographical location…

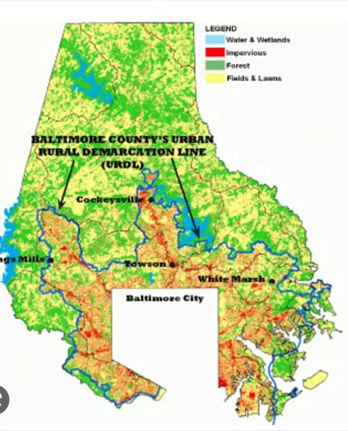

Read MoreLAND LESSONS- What is the Baltimore County URDL?

The Urban-Rural Demarcation Line (URDL) divides the county into 2 categories, “urban” and “rural”. This Urban Rural Demarcation Line shows where growth is encouraged and where land should remain farmland. After World War II, millions of young veterans returned to America anxious to marry and start their families. In Baltimore County in the late 1940s,…

Read MoreLAND LESSONS- What are the differences between a site plan and a plot plan?

Plot Plans are scaled drawings that indicate the size, shape, and location of the lot as well as any improvements that have occurred. Most plot plans include the location of utility lines, trees, and fences. Plot plans are typically reserved for a smaller individual project – the construction of a single-family home, installation of a…

Read MoreLAND LESSONS- What is the Maryland Agriculture Recapture Tax?

In an effort to promote the raising of livestock or the growing of agricultural outputs such as grains, nuts, fruits and vegetables, Maryland assesses land used for productive agriculture at a lower taxable value. This yields the tax on a farmer’s field in the hundreds of dollars rather than thousands of dollars compared if the…

Read More